Buying journey insurance coverage is essential earlier than occurring a Royal Caribbean cruise, and when you journey regularly, you’ll need to think about an annual journey insurance coverage plan.

Defending your cruise trip within the case of medical emergencies, journey delays, or different unexpected mishaps shouldn’t be neglected. Having journey insurance coverage ensures you’ll be coated if issues don’t go to plan at any level throughout your journey.

As an alternative of buying journey insurance coverage for every particular person journey, although, you would possibly need to buy an annual journey insurance coverage plan. Let’s check out what these plans supply and the way they are often a superb worth when you journey a number of instances all year long.

What’s annual journey insurance coverage, and why do you have to think about it?

Annual journey insurance policy present insurance coverage protection for one yr of journey, subsequently offering protection for a number of journeys versus a trip-by-trip foundation. For one set worth, you’ll obtain journey insurance coverage on a full yr’s price of journeys (supplied the vacation spot is 100+ miles from your house).

It’s best to think about annual journey insurance coverage when you journey greater than 2-3 instances in the course of the yr. Annual journey insurance coverage works not just for cruises, however all forms of touring and holidays. Even when you solely plan to take one cruise per yr, your annual journey insurance coverage plan will work for another journeys you could have booked all year long, whether or not brief weekend getaways or enterprise journeys.

The price of an annual journey insurance coverage coverage will fluctuate relying on the precise protection you require, your age, and the place you reside.

My Allianz Annual Journey Insurance coverage plan, for instance, prices $280 for the yr, which I discover to be extraordinarily cheap contemplating buying insurance coverage on a trip-by-trip foundation can simply be rather more costly in the middle of a yr.

What does journey insurance coverage cowl whereas on a cruise, and why ought to I get it?

It’s by no means a good suggestion to go on a cruise with out journey insurance coverage. When you could need to save the added expense and put the cash towards one thing enjoyable in your cruise trip, comparable to a shore tour or eating bundle, don’t underestimate the significance of journey insurance coverage.

Many passengers partake in lively actions on a cruise trip that they could not do typically at residence, comparable to jet-skiing, zip lining, kayaking, and horseback driving. Any lively exercise comes with a threat, and you can’t predict when you’ll want medical consideration whereas in port or onboard.

As a result of common medical insurance coverage won’t often cowl medical companies onboard or in port, it’s really useful to have journey insurance coverage.

Moreover, a cruise trip, like another sort of journey, poses a threat for journey interruption, delays, and different surprising points. From a bag getting misplaced in transit to flight cancellations, it’s all the time higher to be protected than to not have insurance coverage once you want it most.

Journey insurance coverage advantages can fluctuate by coverage, however you’ll be able to anticipate to see the next objects coated:

- Journey cancellation (you need to cancel a visit earlier than you depart)

- Journey interruption (journey plans interrupted whereas on a visit)

- Journey delay protection (with a minimal required delay)

- Baggage delays/loss (misplaced or delayed bag by an airline, cruise line, or different journey provider)

- Rental automobile injury and theft protection

- Emergency transportation protection

- Emergency medical/dental protection

- Medical bills on a cruise

- Journey accident protection

- Epidemic/pandemic protection

What is the draw back of an annual journey insurance coverage plan?

One distinction price noting about an annual journey insurance coverage plan versus buying particular person journey insurance coverage insurance policies is the protection quantities.

The full coverages may be much less with an annual plan in comparison with a person plan. Definitely an annual plan will cowl the necessities, however in case you are wanting so as to add the utmost protection when it comes to liabilities, particular person journey insurance policy can typically embrace larger quantities.

Our Annual Journey Insurance coverage Plan advice

Right here at Royal Caribbean Weblog, we defend our journeys with an annual journey insurance coverage plan by means of Allianz. Allianz Journey affords journey insurance coverage for particular person journeys, annual plans, and automobile leases.

To be clear, Royal Caribbean Weblog has no affiliation with Allianz. We identical to what they provide.

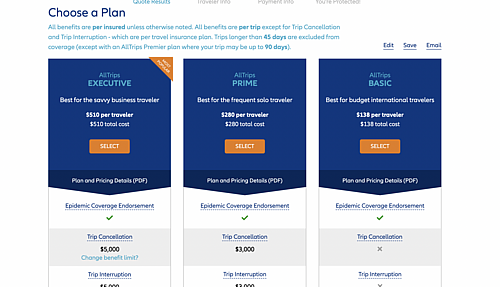

They provide three forms of annual journey insurance policy: Government, Prime, and Primary. We suggest the Prime choice for one of the best stability of affordability and protection.

It’s vital to notice that journeys longer than 45 days are excluded from protection below these plans. Except you’re planning six back-to-back cruises in a row, this shouldn’t be a difficulty for many vacationers.

You’ll be able to learn extra in regards to the annual journey insurance policy on Allianz’s web site right here.

What if I’ve a bank card with journey advantages?

Choose premium bank cards supply journey insurance coverage perks–supplied you ebook the journey with that bank card. Nevertheless, you need to weigh the advantages provided by means of your bank card versus a standard journey insurance coverage plan earlier than relying in your bank card’s insurance coverage.

Not all playing cards supply emergency medical protection or larger limits of journey cancellation safety. Examine the next particulars earlier than utilizing solely your bank card’s journey insurance coverage earlier than a cruise:

- What is roofed below your bank card’s journey safety?

- What’s the restrict on reimbursement for each particular person journeys and the utmost reimbursement per yr?

- Does this card cowl medical bills on a cruise ship?

- What’s the most quantity of days coated per journey by means of your bank card insurance coverage?

- Does the cardboard cowl simply you or anybody on the journey reservation you booked by means of the cardboard?

It’s unlikely a bank card’s journey safety will supply as a lot safety as an ordinary journey insurance coverage plan, however you need to contact your bank card coverage to verify.