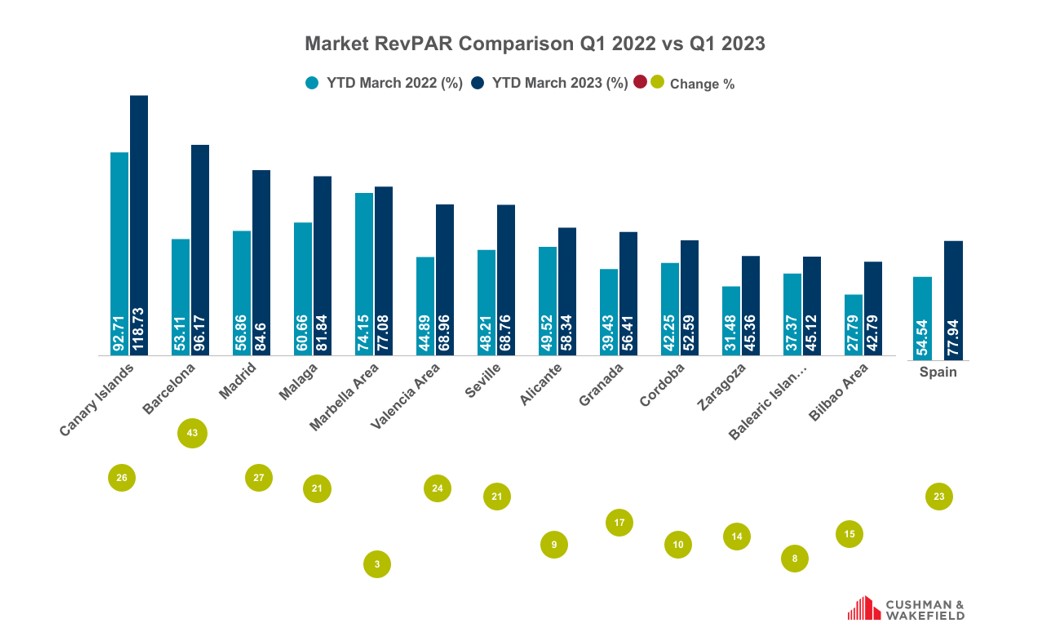

- Spanish inns recorded common occupancy of 65% throughout the first quarter of 2023, an increase of 26.4% on the determine for a similar interval the earlier 12 months when the Omicron variant was impacting outcomes. The restoration in demand has pushed rises in common every day charges (ADR) to €120, leading to income per out there room (RevPAR) at €78, representing progress of some 43% on the figures for 2022. When evaluating to common charges in 2019, Spanish inns have seen progress of 15% in Q1 2023, with Madrid standing out at 20% (€129 this 12 months in comparison with €107 in 2019).

- When it comes to the perfect performing lodge markets in Spain, due to the historically peak season throughout Q1 2023, the Canary Islands headed up the rating with 82% occupancy and €119 RevPAR (vs 79% occupancy and €95 RevPAR in 2019). When it comes to cities, Barcelona confirmed the best enchancment compared with the earlier 12 months, with 43% progress in occupancy (67% vs. 47%) and 27% improve of ADR (€143 vs. €113). This resulted in spectacular 81% RevPAR progress (€96 vs. €53).

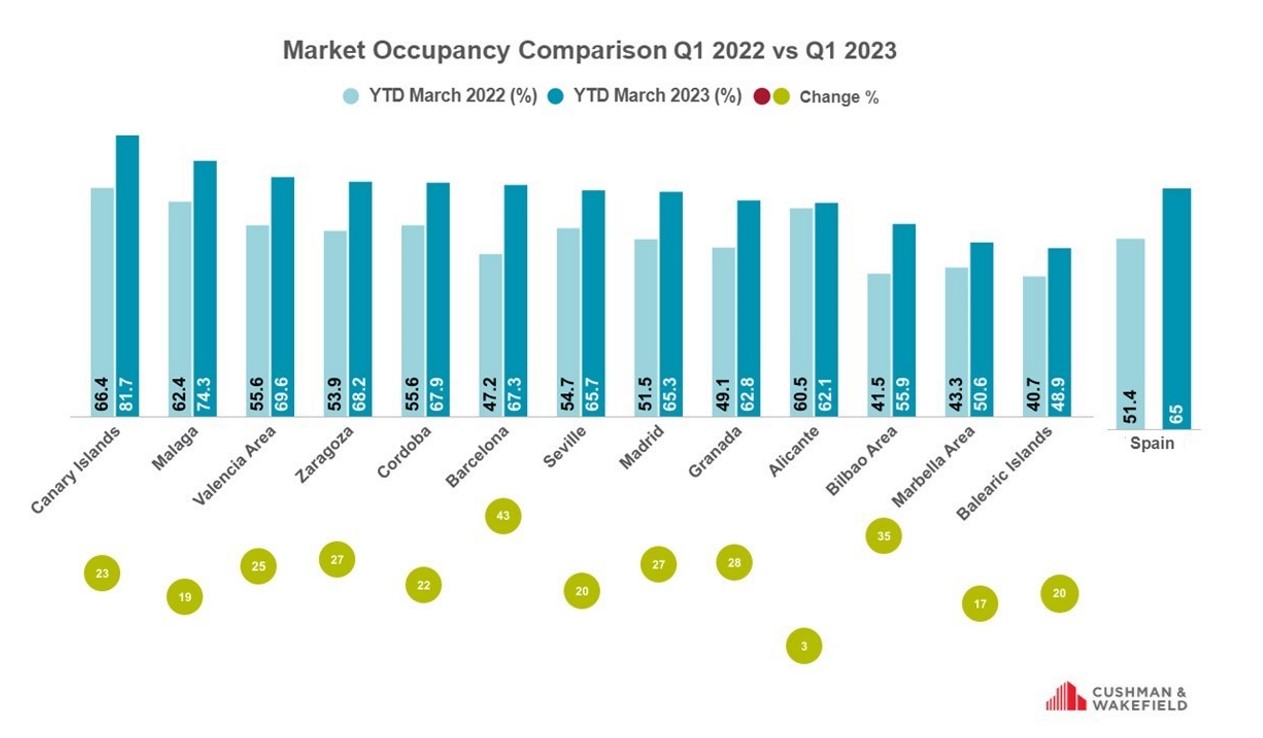

Madrid/Barcelona, April 26, 2022.- Produced collectively by STR and Cushman & Wakefield, the Lodge Sector Barometer exhibits a full restoration of lodge efficiency in Spain, following the restrictions imposed throughout the pandemic. This restoration is embodied by a wholesome occupancy throughout the first quarter at 65%, some 26.4% greater than final 12 months and solely two share factors under the determine achieved in 2019.

Turning to the ADR (common every day price), the Spanish inns recorded some 13% progress throughout Q1 2023 (in comparison with identical interval final 12 months), reaching €120. This mixed with a robust occupancy progress resulted in a sturdy 43% RevPAR improve, reaching €78 throughout Q1 2023 (versus €54 for a similar interval final 12 months). The ADR for Spain as an entire stood at €103 in 2019, together with a RevPAR of €69, which means that progress in 2023 quantities to some +16% and +13% respectively.

When it comes to locations, the Canary Islands and Malaga high the occupancy leader-board

Comparable to their peak season, the Canary Islands confirmed their place throughout the first quarter with occupancy rising to 82% (66% final 12 months and 79% in 2019). Malaga was the runner-up with occupancy of 74.3%, 12 share factors over the determine for the earlier 12 months and half a degree greater than in 2019 and demonstrating that the capital of the Costa del Sol is attracting tourism all year long in response to its dedication to cut back seasonality. Amongst different cities, Barcelona has proven important enchancment by reaching occupancy of 67% throughout the first three months of the 12 months compared with 47% in 2022 (progress of 43%).

With among the many lowest occupancies have been the locations most impacted by seasonality, comparable to Marbella (50%) and the Balearic Islands (49%).

In accordance with César Escribano, Regional Supervisor Southern Europe at STR, “the restoration in exercise has sped up throughout this quarter, with excellent figures for Madrid and Barcelona in anticipation of how the 12 months will evolve, the pre-summer indicators remaining constructive”.

For his half, Bruno Hallé, Associate and Co-head of Cushman & Wakefield Hospitality Spain,

considers that “now we have witnessed a V-shaped restoration for the reason that finish of the pandemic, with value will increase responding to the energy of demand and inflationary pressures. The actual problem now could be to make sure that working income don’t undergo on account of price will increase”.

The ADR reached €120 within the first quarter, some 15% above the determine for 2019 and 13% greater than final 12 months

Room charges have continued to development upwards for the reason that restoration in exercise, benefiting from the robust demand but in addition beneath pushed by inflation. Customers are accepting this improve, enabling inns to lift ADR as much as €120 throughout the first quarter of 2023. At €152, Marbella tops the rating of common room charges regardless of low occupancy. It’s adopted by the Canary Islands at €145 and Barcelona at €143 (7.5% greater than in 2019), each benefiting from worldwide tourism. For its half, Madrid recorded an ADR of €129. This glorious determine is a few 20% up on the €107 for a similar quarter in 2019, previous to the pandemic.

The Spanish locations exceeding an ADR of €100 notably embrace Malaga (€110) and Seville (€105), with Valencia nearly crossing this threshold (€99). The bottom ADR was present in Zaragoza (€66).

In accordance with Albert Grau, Associate and Co-head of Cushman & Wakefield Hospitality Spain “the lodge trade has demonstrated that bettering product high quality represents a protected wager in that it strengthens demand, grows loyalty and permits value will increase according to market situations”.

The RevPAR for the primary quarter stands at €78, representing progress of some 43% compared with the start of 2022.

The rise in occupancy and value will increase have enabled hoteliers to develop RevPAR (income per out there room). Due to the coincidence with its peak season, the Canary Islands topped the RevPAR rankings throughout the first quarter, reaching a determine of €119. That is some 28% above that achieved final 12 months and even 25% above 2019’s figures (€95).

Though the primary quarter is historically off-season for almost all of locations in Spain, RevPAR grew very considerably in cities comparable to Barcelona (+81%), Valencia (+54%) and Madrid (+49%). As soon as once more, we discover the bottom figures for RevPAR in Zaragoza (€45) and the Balearic Islands (€45), within the latter case because of low occupancy on account of the diploma of seasonality.

The Lodge Sector Barometer brings collectively knowledge from 1,200 inns and round 150,000 rooms on the Iberian Peninsula. The research is the product of an alliance between STR, a worldwide supplier of benchmarking, analytics and market information specialising within the lodge sector, and Cushman & Wakefield Spain, the world chief in actual property providers.

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a number one world actual property providers agency that delivers distinctive worth for actual property occupiers and homeowners. Cushman & Wakefield is among the many largest actual property providers corporations with roughly 52,000 workers in over 400 workplaces and roughly 60 nations. In 2022, the agency had income of $10.1 billion throughout core providers of property, amenities and venture administration, leasing, capital markets, and valuation and different providers.

Cushman & Wakefield has over 30 years’ expertise in Spain and the corporate’s enterprise covers all the territory. The top workplaces are situated in Madrid (Edificio Beatriz, José Ortega y Gasset, 29, 6º) and Barcelona (Passeig de Gràcia, 56, 7º). For additional info, please go to www.cushmanwakefield.es or comply with @CushWake on Twitter.

About STR

STR gives premium benchmarking, analytics and market outlook info to shoppers from a number of sectors. Based in 1985, STR is current in 15 nations and headquartered in Hendersonville, Tennessee, United States. The worldwide head workplace is in London, UK and there’s one other head workplace for Asia-Pacific, in Singapore. In October 2019, STR was acquired by the CoStar Group, Inc. (NASDAQ: CSGP), the main supplier of enterprise info on actual property property, evaluation and on-line markets. For additional info, please go to str.com and costargroup.com.

Additional info:

Roman – Status Issues

Víctor Palacio

Tel: 689 675 376 / 677 782 370

Marina Huete

Tel: 93 414 23 40

STR

César Escribano

Regional Supervisor Southern Europe [email protected]

Bruno Halle

Associate – Co-Head of Hospitality Spain

Cushman & Wakefield