Debate continues on the extent to which international tourism restoration shall be impinged by rising inflationary pressures and potential journey disruption.

To this point, any potential influence has not been seen within the hospitality sector. The STR Market Restoration Monitor, based mostly on information for the week ending 30 July 2022, confirmed that greater than 90% of North American markets and round 80% of world markets had been reaching income per obtainable room (RevPAR) that was 80% or above 2019 ranges when adjusted for inflation.

Nonetheless, the anticipated seasonal slowing of peak leisure demand season is starting and intersecting with important macroeconomic headwinds. With that in thoughts, STR examined the attitudes of shoppers within the present context of contrasting tourism fortunes. In the end, we need to proceed monitoring how journey sentiment is being impacted by rising monetary and journey pressures alongside easing COVID-19 issues.

Our newest survey from July 2022 highlights that buyers are vigilant about their private funds and COVID-19, however wanderlust continues to stoke journey demand even with extra concern round journey disruption.

Stalling short-term sentiment, optimistic long-term outlook

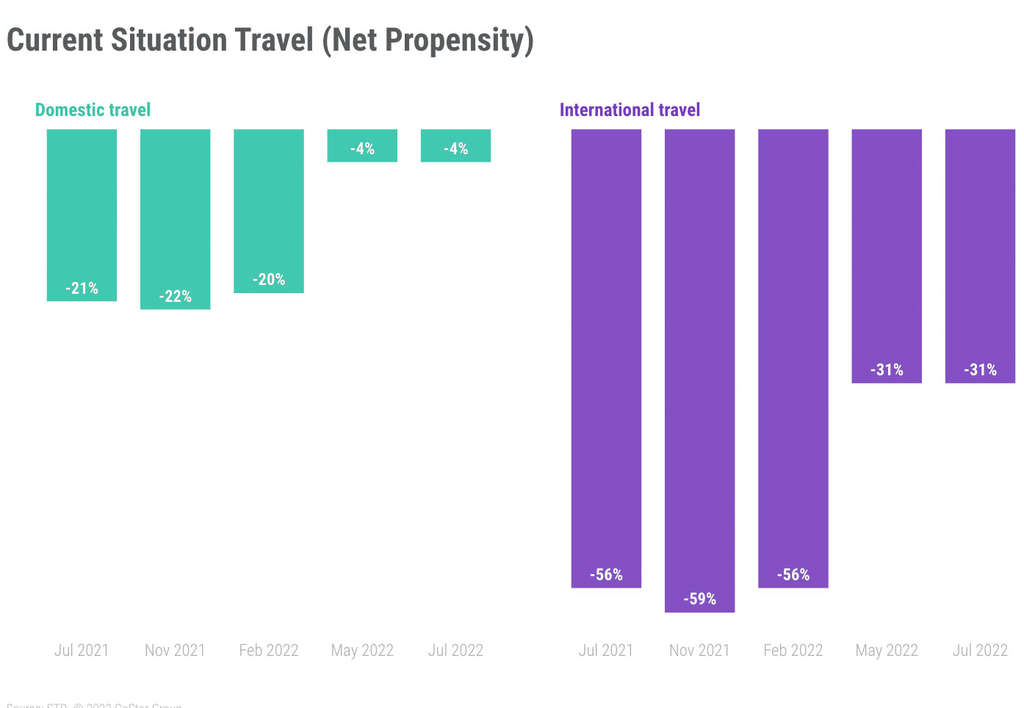

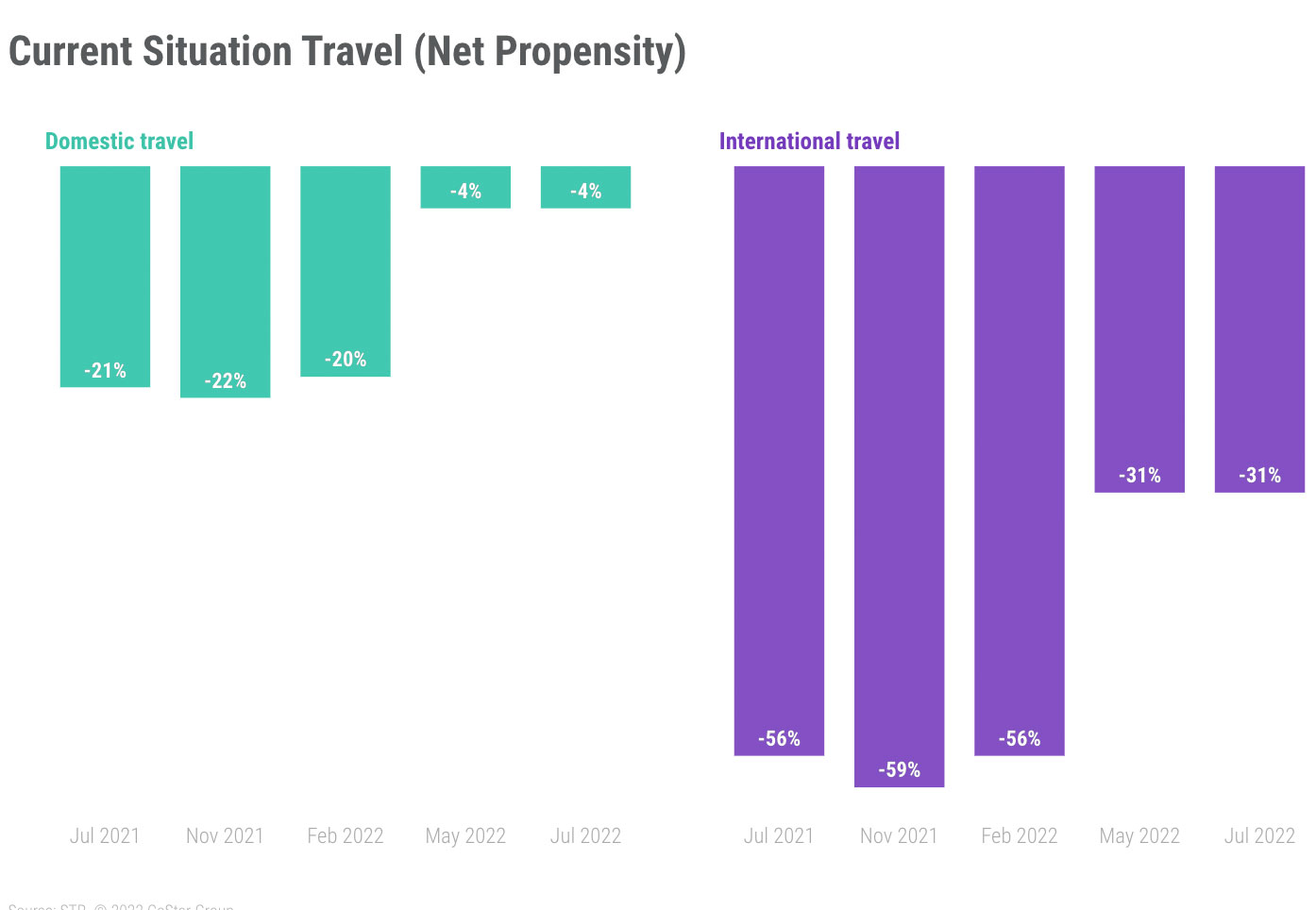

Throughout earlier analysis in Might 2022, STR confirmed an uptick in sentiment as web propensity to journey – the distinction between those that said they had been kind of more likely to journey within the present atmosphere – elevated considerably for each home and worldwide journeys in contrast with February 2022.

Nonetheless, the newest findings revealed an identical sentiment with Might 2022 as web propensity to journey within the present state of affairs was unchanged, remaining in destructive territory for each home and worldwide journeys (-4% and -31%, respectively). Whereas the outlook improved in contrast with final yr, these outcomes counsel that monetary pressures, COVID-19 and different elements proceed to overwhelm the general attraction of journey at the moment.

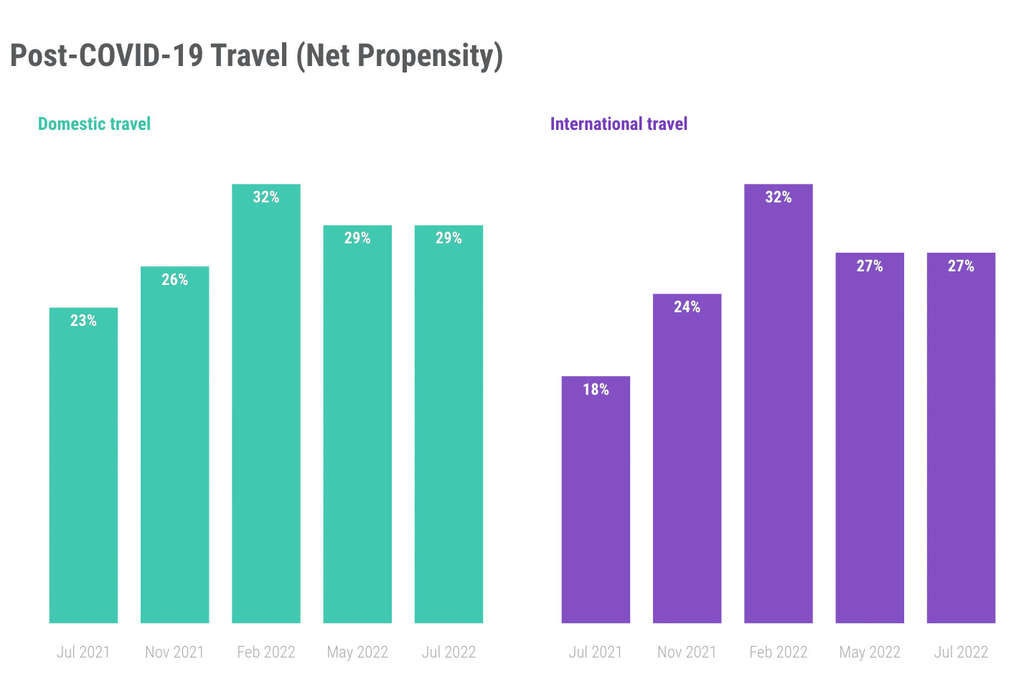

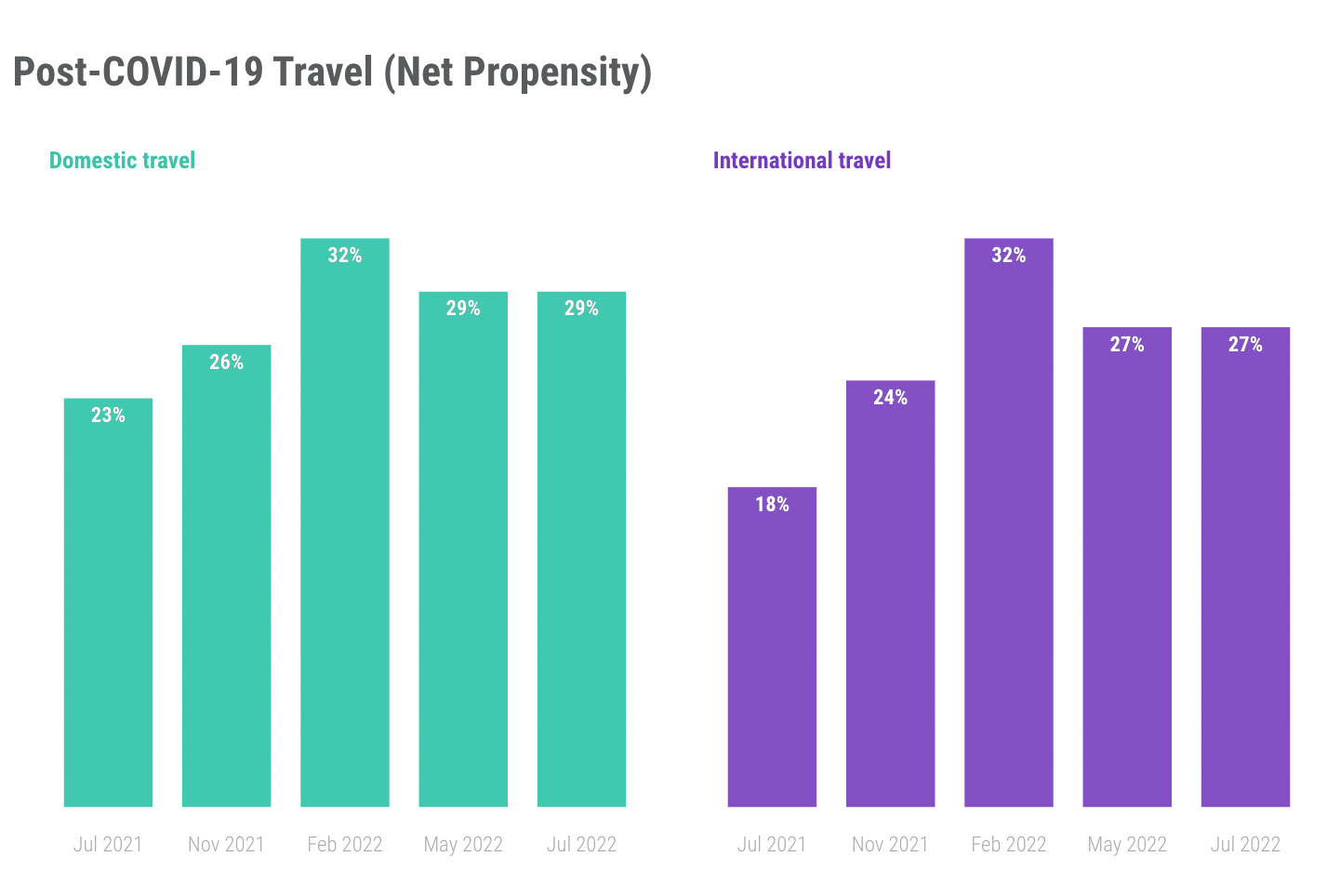

Regardless of stalling short-term sentiment, attitudes towards tourism within the medium- to long-term remained extraordinarily optimistic. Internet propensity to journey was once more near +30% for each home and worldwide journeys. These outcomes sign wholesome intent amongst shoppers to extend their journey cadence sooner or later and the continued presence of robust underlying demand.

New barrier on the block: Journey cancellations

Journey cancellations and disruptions have been a lot publicized lately as airways and airports, particularly, have needed to handle surging demand alongside supply-chain and staffing points. Journey disruption issues consequently emerged as a big barrier to journey with many probably influenced by media reviews in addition to first-hand and anecdotal destructive experiences.

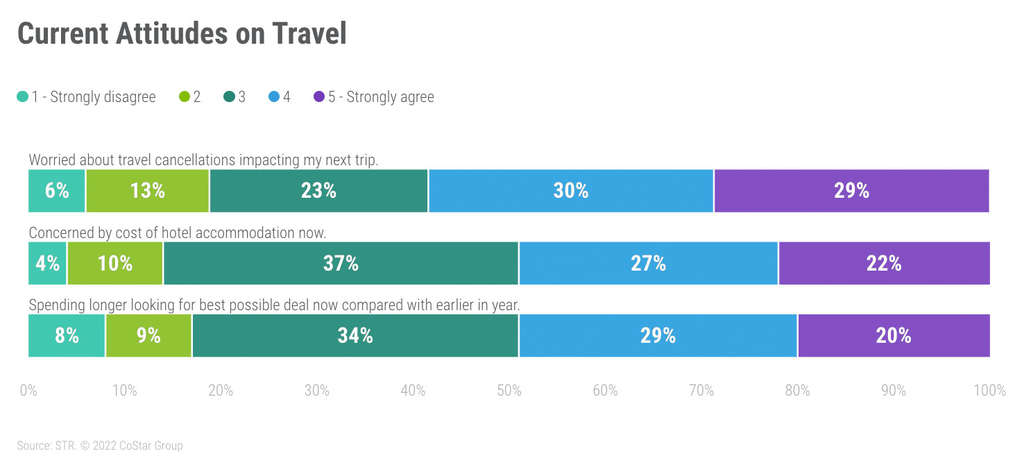

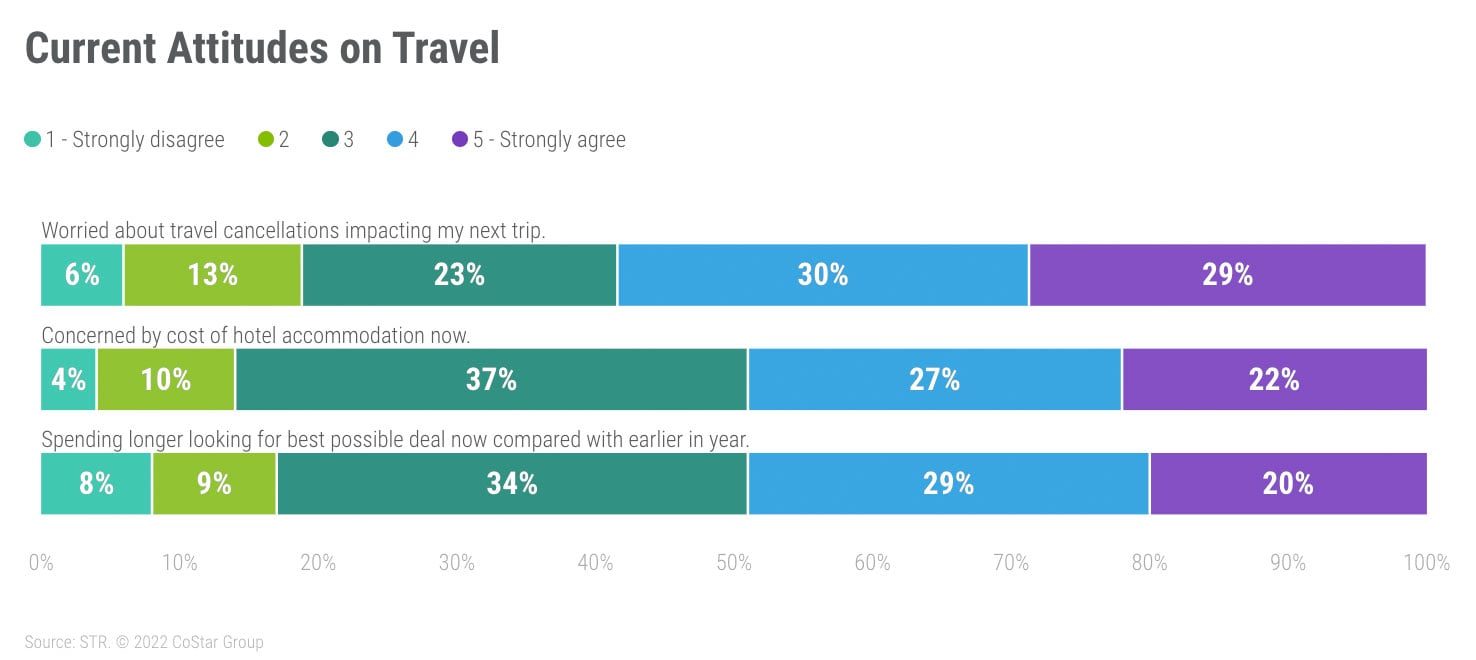

Total, almost six in 10 stated they’re frightened about cancellations and disruptions impacting their subsequent journey. North Individuals expressed extra concern than others as 63% had been anxious about journey disruption in contrast with 54% amongst Brits and Europeans.

In the meantime, round half agreed they’re involved by the price of lodge lodging now and the same proportion stated they’re spending extra time searching for offers. These findings counsel shoppers are more and more scrutinizing the price of journey but stay desperate to get away. How shoppers commerce off rising prices with the advantages of journey is a key concern which may form international tourism efficiency within the coming months.

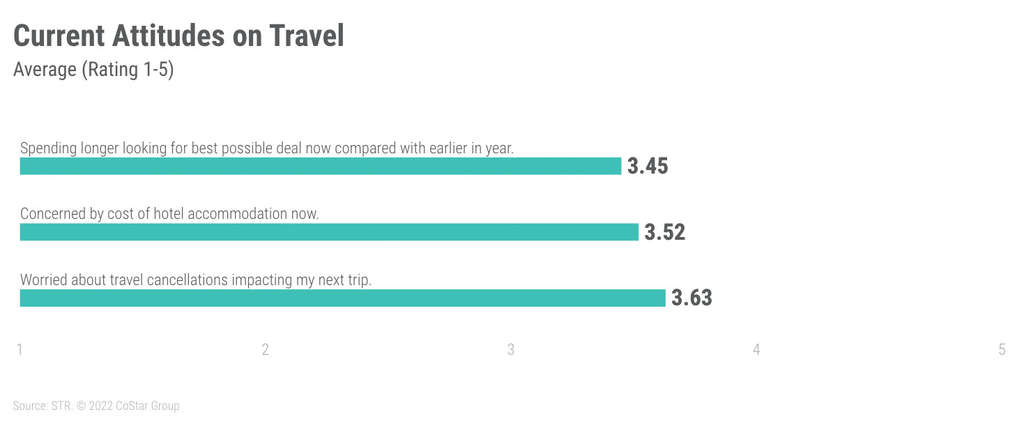

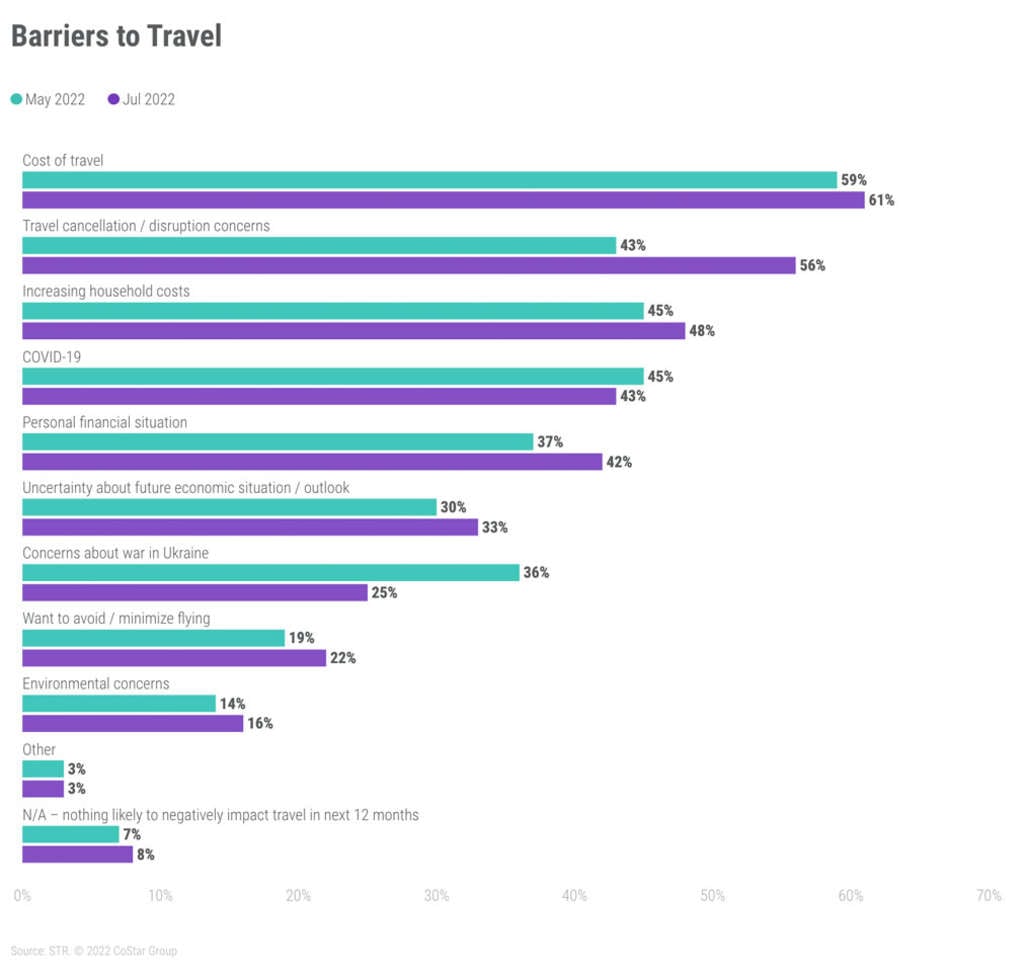

Monetary elements are higher threats, concern across the battle in Ukraine decreased

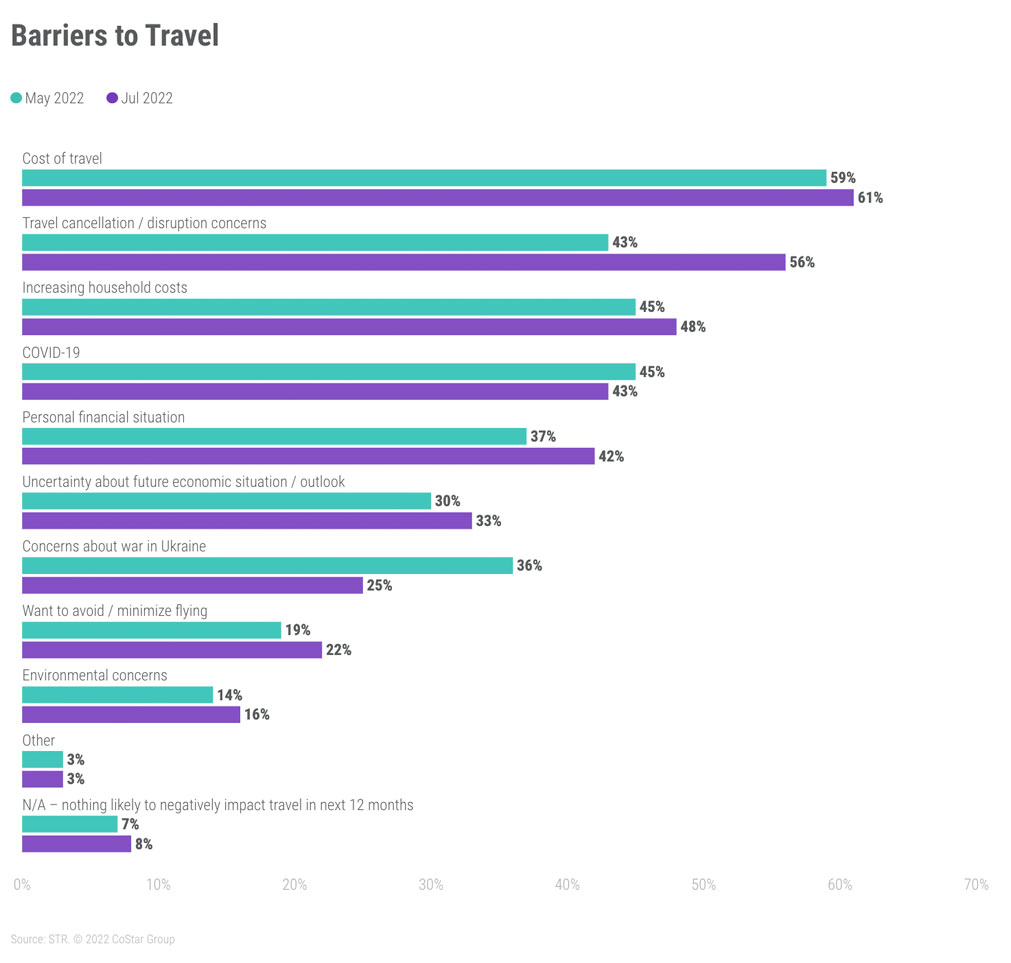

The price of journey stays the largest impediment to tourism progress. In keeping with Might 2022, round 60% thought prices would negatively influence journey within the subsequent 12 months. Unsurprisingly for the explanations mentioned above, the second best barrier was journey cancellations and disruptions talked about by 56% in contrast with 43% in Might 2022.

There was a sample additional down the pecking order in general significance as different monetary obstacles – rising family prices, private monetary conditions and financial uncertainty – elevated in contrast with Might 2022. These findings spotlight that financial issues have strengthened in current months. How the world economic system unfolds will decide if these obstacles pose a extra important risk for tourism later within the yr.

In the meantime, conversely, the battle in Ukraine was perceived to be a lesser journey barrier than in Might 2022. 1 / 4 thought it might negatively influence their travels within the subsequent 12 months, which was nicely beneath Might 2022 (36%). Europeans although had been extra guarded than others in regards to the battle with 31% seeing it as a barrier.

Price-benefit evaluation reckoning lies forward

The outlook for journey stays upbeat as a result of robust underlying demand regardless of rising financial uncertainty and inflationary pressures. Journey disruption issues had been presumably a much bigger issue than monetary points, which led to the muted sentiment on this newest survey. The excellent news is that journey disruptions, not like monetary points, are one thing the business can deal with as soon as staffing and supply-chain points have eased. The seasonal dip in future demand will even permit companies to higher handle the state of affairs.

Nonetheless, these elements mixed with lingering COVID-19 issues create a difficult backdrop for tourism. Tourism companies, like shoppers, shall be eagerly monitoring authorities efforts to mitigate the financial challenges forward. How shoppers with lowering actual incomes consider the general value and advantage of journey will even influence efficiency going ahead. Journey disruption – each perceptions and actuality – is more likely to stay a topical concern in the course of the remaining interval of peak season journey.

About STR

STR offers premium information benchmarking, analytics and market insights for the worldwide hospitality business. Based in 1985, STR maintains a presence in 15 nations with a company North American headquarters in Hendersonville, Tennessee, a world headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the main supplier of economic actual property data, analytics and on-line marketplaces. For extra data, please go to str.com and costargroup.com.