What a distinction a 12 months makes – within the 2022 version of Tendencies® within the Resort Trade, we wrote that main markets had been nonetheless attracting builders and that new provide development among the many nation’s 65 main markets was anticipated to document an annual achieve of 1.7%, which is above the long-run common of 1.5%. Nevertheless, over the previous 12 months, the market situations have modified with rising building prices, rising financing prices, much less financing choices brought on by the latest turmoil within the banking business, and market uncertainty coming to the forefront, together with the restoration from the COVID-19 pandemic nonetheless taking part in an element.

The price of building supplies, labor and land has been rising steadily lately throughout the nation. Relying on the property’s particular location, class and franchise, lodge building prices have elevated between 10% and 20% in most markets lately, which is chopping into the developer’s revenue for a given improvement. With that mentioned, it seems building prices might have peaked, and going ahead, extra typical, inflationary degree will increase in building prices are anticipated within the near-term.

Financing prices have risen over the previous 12 months and up to date turmoil within the banking business brought on by the collapse of Silvergate Financial institution, Silicon Valley Financial institution, and Signature Financial institution are additionally making it a problem for builders to safe financing for brand spanking new initiatives. The Federal Reserve started rate of interest hikes in March 2022, trying to curb inflation. As of the date of this publication, CBRE is forecasting rates of interest to peak in mid-2023 and the Fed might start chopping rates of interest later in 2023. Certainty on the rate of interest outlook will present some stability for capital markets exercise as soon as that happens. Nevertheless, the Fed’s insurance policies might provoke a recession in 2023 or 2024 – CBRE’s financial forecast as of March 2023 calls for 2 consecutive quarters of damaging GDP development over the past half of 2023. If a recession involves fruition, there may be uncertainty concerning the magnitude of the recession and the way lengthy it is going to final.

Because of all these elements, it has been troublesome for lodge builders to establish possible lodge developments. The provision development of recent lodge rooms decreased in 2020 by means of 2022 because the lodge market confronted challenges from COVID-19 and the restoration from the unprecedented pandemic. With the beforehand famous headwinds the market is presently dealing with, this development is more likely to proceed over the following a number of years.

Trying again, from 2016-2019, the typical annual price of lodge room provide development throughout america was 1.8% in contrast with the typical annual price of room night time demand development of 1.9%. New provide development dipped to 1.2% in 2020, 1.2% in 2021 and 0.5% in 2022. The February 2023 version of CBRE’s Resort Horizons® initiatives new provide development to rise above the 2022 degree enhance at a median price above 1% for the following three years. This tempo is properly under the quantity of recent provide development skilled earlier than the COVID-19 pandemic, and fewer than the two.5% tempo of demand development over the following three years.

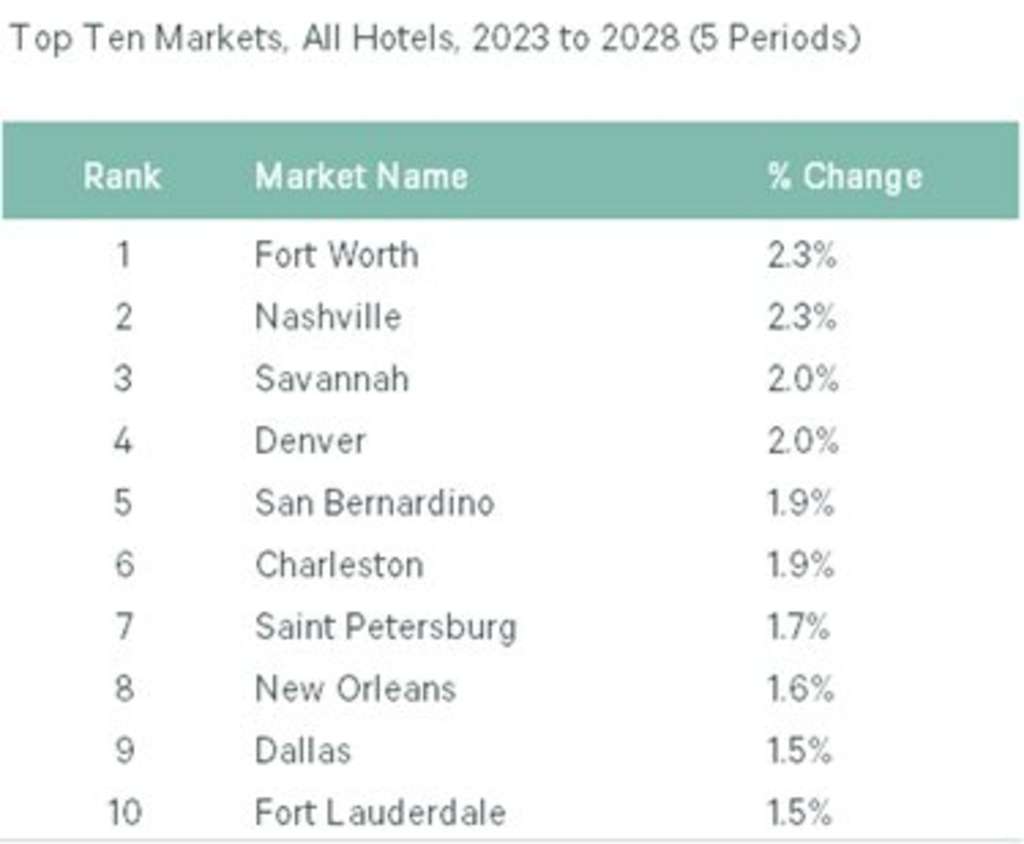

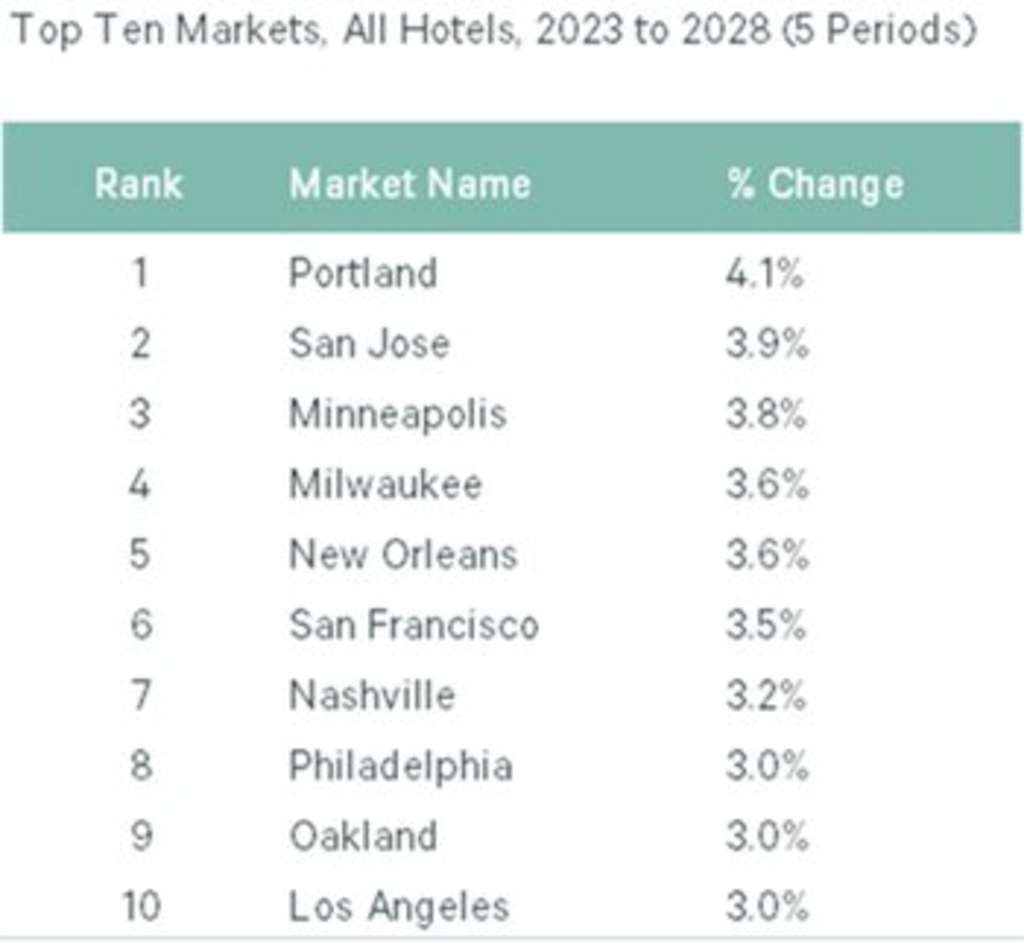

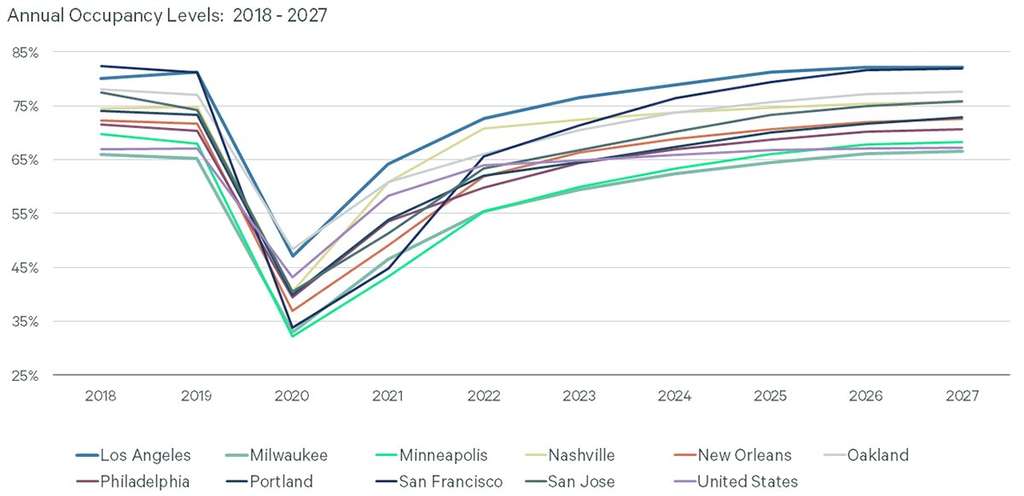

These provide and demand development price figures are nationwide figures, and the influence of slower provide development is extra pronounced on a market degree. The next two lists rank the High 10 markets for forecasted new provide development and room night time demand development over the following 5 years.

— Supply: Supply: CBRE Accommodations Analysis, This autumn 2022.

— Supply: Supply: CBRE Accommodations Analysis, This autumn 2022.

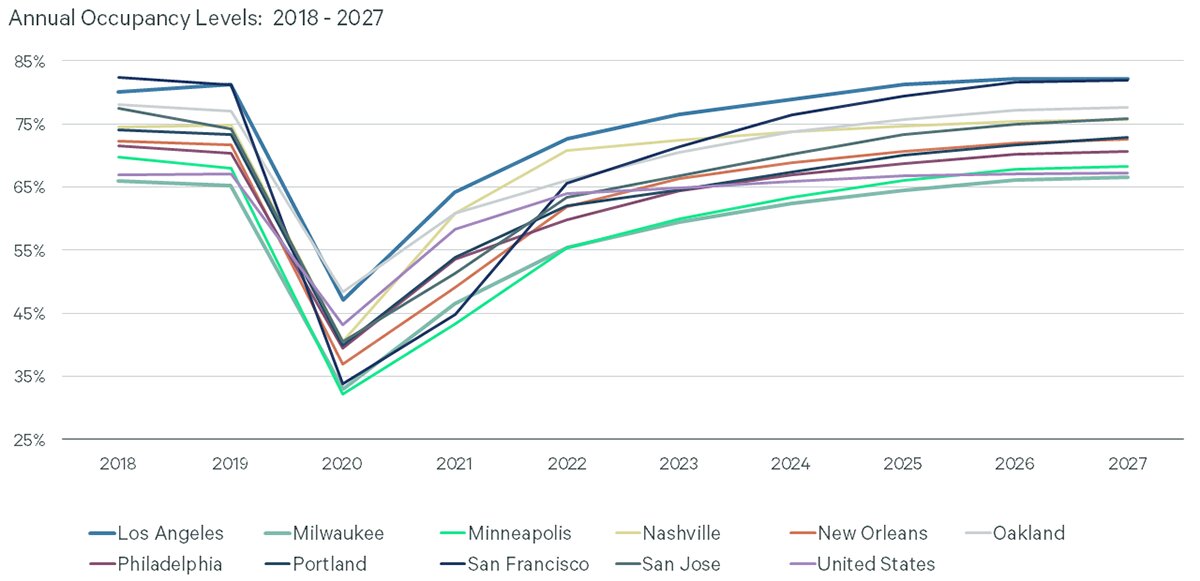

As is illustrated, solely two markets (New Orleans and Nashville) seem in each lists. Not shocking, as is proven within the following illustration, all 10 of the highest demand development markets are forecasted to expertise robust occupancy positive aspects over the following 5 years, properly above the occupancy development charges forecasted for america as a complete, which is projected to kind of degree out starting in 2024.

— Supply: Supply: CBRE Accommodations Analysis, This autumn 2022.

The discount in new lodge provide development might trigger a number of outcomes for the lodge market, together with increased occupancy charges, rising room charges for current accommodations, and repositioning alternatives for older, inferior accommodations. If precise demand development charges exceed what’s forecasted in our fashions, the lodge market might be dealing with a lodge room provide scarcity, which might gas the expansion in occupancy charges and room charges. This might be a welcomed reprieve for the operators of many current accommodations which might be pursuing increased occupancy charges, nearer to pre-COVID-19 ranges. With that mentioned, franchisors and market forces will seemingly place increased property enchancment plan necessities on current accommodations to justify increased charges and keep a aggressive benefit within the wake of decrease lodge provide development in lots of markets. Additional, speculative lodge builders banking on a stronger than anticipated restoration might profit from the gamble if the market outperforms expectations.

With the downturn from COVID-19 principally within the rearview mirror, an obvious moderation of building prices, and rate of interest will increase more likely to peak in 2023, we await the impacts from the Fed’s insurance policies to see if a recession happens and to what extent the potential recession impacts the general economic system and the lodge market extra particularly. As soon as that turns into clearer, we can have a greater thought of how the diminished new lodge provide will truly influence the lodge market. As all the time, we’ll proceed to replace our forecasts and fashions as we obtain new information factors.