Ascott Residence Belief (ART) has achieved robust restoration with the very best quarterly enhance in income per accessible unit (REVPAU1) of 85% in 2Q 2022 since 2Q 2020. ART’s REVPAU jumped 91% to S$124 in 2Q 2022 in comparison with 2Q 2021. Its sturdy working efficiency was attributable to larger common every day price and common occupancy price which grew from about 50% in 1Q 2022 to about 70% in 2Q 2022. ART’s properties in United States of America (USA), United Kingdom, Singapore and Australia registered the strongest quarter-on quarter progress in REVPAU. In 1H 2022, REVPAU rose 60% to S$96 in comparison with the earlier yr.

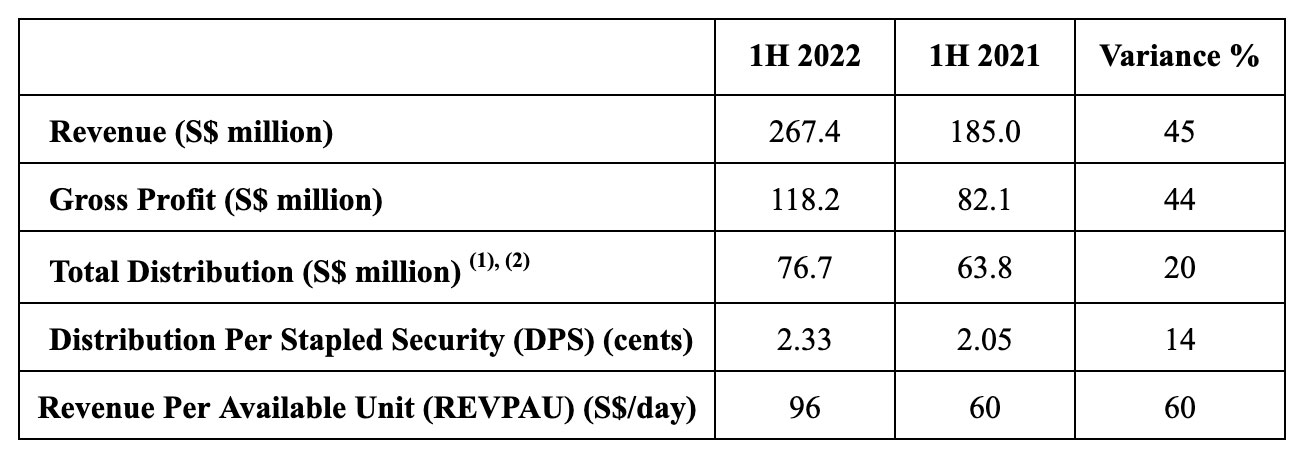

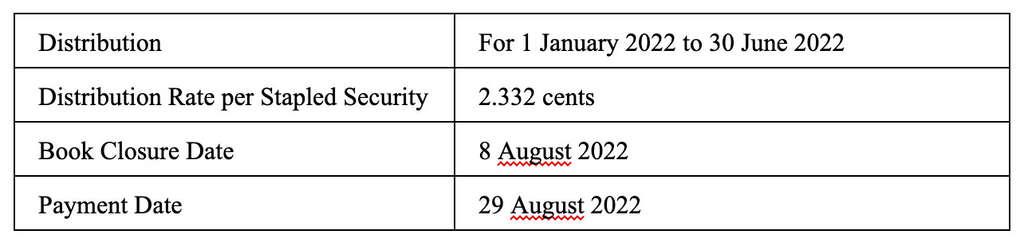

ART has elevated its distribution per Stapled Safety (DPS) for 1H 2022 by 14% to 2.33 cents in comparison with 1H 2021. ART’s whole distribution additionally grew 20% to S$76.7 million in comparison with 1H 2021. The entire distribution for 1H 2022 included realised alternate achieve arising from compensation of overseas foreign money financial institution loans. Excluding one-off objects2, ART’s adjusted DPS rose 120% yr on-year to 1.78 cents on stronger working efficiency.

Income for 1H 2022 elevated by 45% to S$267.4 million in comparison with 1H 2021. This was primarily attributed to larger income from ART’s present portfolio, contributions from its expanded portfolio of longer-stay property comprising scholar lodging and rental housing properties, in addition to from the newly opened lyf one-north Singapore. Gross revenue for 1H 2022 additionally grew 44% to S$118.2 million in comparison with 1H 2021. On a similar retailer foundation3, income and gross revenue in 1H 2022 elevated by 32% and 28% respectively in comparison with 1H 2021.

Mr Bob Tan, Chairman of Ascott Residence Belief Administration Restricted (ARTML) and Ascott Enterprise Belief Administration Pte. Ltd. (the Managers of ART) mentioned: “As the worldwide journey restoration continues, our serviced residences and lodges have contributed extra progress revenue. This builds upon the regular revenue stream from our robust basis of longer-stay property. ART’s diversified and resilient portfolio stays poised for additional progress. As well as, our sturdy monetary place offers us the capability to realize our asset allocation goal of 25-30% in longer-stay property and 70- 75% of our portfolio in serviced residences and lodges.”

Ms Serena Teo, Chief Government Officer of ARTML and Ascott Enterprise Belief Administration Pte. Ltd. (the Managers of ART) mentioned: “As Asia Pacific’s largest hospitality belief, ART is a key barometer of the sector’s efficiency. Our high quality hospitality properties stay extremely wanted by company and leisure friends, and the pent-up demand has enabled ART to realize our highest enhance in REVPAU over the past quarter. We’re seeing robust ahead bookings at our properties and we anticipate this demand to maintain. With our geographically various community of serviced residences and lodges in key gateway cities and huge home markets, ART has the agility to cost our room charges dynamically to abate rising utility and labour prices, and higher seize progress alternatives. As our properties cater primarily to long-stay friends, we have now decrease manning necessities and leaner price buildings. ART’s secure revenue base is predicted to cushion the impression from recessionary issues, rising inflation and macroeconomic uncertainties.”

Enhancing the resilience of ART’s portfolio by the longer-stay section ART’s secure revenue sources4 contributed 68% of its gross revenue in 1H 2022 whereas the remaining 32% had been revenue from administration contracts from serviced residences and lodges.

ART’s seven working scholar lodging properties within the USA and three rental housing properties in Japan acquired over the past yr have robust common occupancy price of over 95%. For the scholar lodging properties in USA, beneficial pre-leasing for the subsequent tutorial yr have been noticed with three of the properties being absolutely leased. The typical pre-leasing price of the scholar lodging properties is about 95%; with an anticipated hire progress of about 8% year-on-year.

In March 2022, ART accomplished the acquisition of its first scholar lodging property in Japan, Eslead Faculty Gate Kindaimae. When the acquisition of 4 rental housing properties is accomplished between 4Q 2022 and 2Q 2023, they’re anticipated to additional add to the secure revenue streams of ART. The acquisition will enhance ART’s longer-stay properties to 17% of its whole portfolio worth, conserving ART on observe to realize its medium-term asset allocation goal of 25- 30%.

Rejuvenating ART’s portfolio with new developments

Two properties in ART’s portfolio are at the moment beneath improvement. The coed lodging Normal at Columbia within the USA has topped out in 2Q 2022 and is predicted to finish in 2Q 2023. Building of the brand new Somerset serviced residence on the Liang Courtroom website in Singapore stays on observe for completion in 2H 2025.

ART’s management in sustainability

ART consolidated its popularity as a pacesetter in sustainability. In April 2022, ART was the primary hospitality belief on the planet to launch a S$200 million sustainability-linked bond. Constructing on its recognition because the 2021 ‘World Sector Chief – Lodge’ in GRESB, ART has greened 35% of its international portfolio by sq. metre and goals to inexperienced 50% of its international portfolio by 2025 and 100% of its international portfolio by 2030.

Strengthening ART’s monetary place by disciplined capital and cashflow administration

ART has robust monetary capability and wholesome liquidity place. As at 30 June 2022, ART had a complete of roughly S$1.12 billion in money on-hand and accessible credit score amenities. ART has a debt headroom of S$1.8 billion and a gearing of 37.5%, which is properly under the 50% gearing threshold set by the Financial Authority of Singapore.

To mitigate the impression of rising rates of interest, about 79% of debt are successfully on fastened rates of interest as at 30 June 2022. The weighted common debt to maturity is about three years. Moreover, ART’s debt is denominated in varied foreign currency echange, with rates of interest rising at totally different levels throughout the international locations. ART’s efficient borrowing price stays low at 1.7% every year.

Abstract of Outcomes

- Complete distribution for 1H 2022 included realised alternate achieve arising from compensation of overseas foreign money financial institution loans.

- Complete distribution for 1H 2021 included:

- one-off distribution of divestment achieve of S$20.0 million to share divestment positive factors with Stapled Securityholders, substitute revenue loss from divested property and mitigate the impression of COVID-19 on distributions;

- termination payment revenue acquired upon termination of the sale of Citadines Xinghai Suzhou and Citadines Zhuankou Wuhan;

- realised alternate achieve on the receipt of the divestment proceeds; and

- realised alternate achieve arising from the compensation of overseas foreign money financial institution loans with the divestment proceeds.

Distribution and Guide Closure Date

ART’s distributions, made on a semi-annual foundation, are as follows:

For ART’s 1H 2022 monetary assertion and presentation, please go to www.ascottresidencetrust.com

1 Portfolio REVPAU refers back to the income per accessible unit of properties beneath administration contracts and administration contracts with minimal assured revenue. It excludes grasp leases, rental housing and scholar lodging properties

2 Excluding one-off objects comprising (1) distribution high up of S$20 million in 1H 2021, (2) realised alternate achieve on compensation of overseas foreign money financial institution loans in 1H 2021 and 1H 2022, (3) realised alternate achieve on the receipt of the divestment proceeds in 1H 2021 and (4) termination payment revenue in 1H 2021

3 Excluding acquisitions and divestments

4 Steady revenue sources embrace grasp leases, administration contracts with minimal assured revenue, rental housing and scholar lodging properties

About The Ascott Restricted

The Ascott Restricted (Ascott) is a Singapore firm that has grown to be one of many main worldwide lodging owner-operators. Ascott’s portfolio spans greater than 200 cities throughout over 30 international locations in Asia Pacific, Central Asia, Europe, the Center East, Africa and the USA.

Ascott has greater than 78,000 working models and over 57,000 models beneath improvement, making a complete of greater than 135,000 models in over 800 properties.

The corporate’s serviced condo, coliving and resort manufacturers embrace Ascott The Residence, The Crest Assortment, Somerset, Quest, Citadines, lyf, Préférence, Vertu, Harris, Citadines Join, Fox, Yello, Fox Lite and POP!.

Ascott’s loyalty programme, Ascott Star Rewards, provides unique advantages to its members once they e-book immediately with Ascott for his or her stays at its taking part properties.

Ascott, an entirely owned subsidiary of CapitaLand Funding Restricted, pioneered Asia Pacific’s first international-class serviced condo with the opening of The Ascott Singapore in 1984. At this time, the corporate boasts over 30 years of business observe report and award-winning manufacturers that take pleasure in recognition worldwide.

For extra data, please go to www.discoverasr.com.

About CapitaLand Funding Restricted

Headquartered and listed in Singapore, CapitaLand Funding Restricted (CLI) is a number one international actual property funding supervisor (REIM) with a powerful Asia foothold. As at 31 December 2021, CLI had about S$122.9 billion of actual property property beneath administration, and about S$86.2 billion of actual property funds beneath administration (FUM) held through six listed actual property funding trusts and enterprise trusts, and 29 non-public funds throughout the Asia-Pacific, Europe and USA. Its diversified actual property asset courses cowl built-in developments, retail, workplace, lodging, enterprise parks, industrial, logistics and information centres.

CLI goals to scale its FUM and fee-related earnings by its full stack of funding administration and working capabilities. Because the listed funding administration enterprise arm of the CapitaLand Group, CLI has entry to the event capabilities of and pipeline funding alternatives from CapitaLand’s improvement arm. Being part of the well-established CapitaLand ecosystem differentiates CLI from different REIMs.

As a part of the CapitaLand Group, CLI locations sustainability on the core of what it does. As a accountable actual property firm, CLI contributes to the environmental and social well-being of the communities the place it operates, because it delivers long-term financial worth to its stakeholders.

Go to http://www.capitalandinvest.com/ for extra data.

Joan Tan

Assistant Vice President, Company Communications

+65 6713 2864

The Ascott Restricted