However continued financial uncertainty, Lodging Analytics Analysis & Consulting (LARC) stays inspired by the U.S. lodging {industry}’s latest efficiency and our outlook for 2023 and past which is barely modestly altered.

Macro-economic uncertainty has elevated in latest months as a number of regional banks dissolved and fears of contagion throughout the monetary markets have been in focus. Our assumption is that, with the help of regulators, the monetary sector eradicated any potential systemic danger throughout the monetary system, nevertheless financial institution lending parameters have tightened, which is able to result in a broadbased decline in credit score availability and meaningfully gradual financial development via 2024. Layer on the implications from approaching a U.S. debt restrict breach as a result of incapability to achieve a debt ceiling improve settlement in Washington, D.C. and there are many causes to be cautious about near-term financial development.

Because of these components, consensus now expects the Federal Reserve Board’s (Fed) price improve cycle to have come to an finish. Whether or not the U.S. enters a recession or not could also be a matter of semantics, however regardless, we count on financial development to be restricted via 2024. Moody’s Analytics doesn’t count on a recession of their base case presently, however forecasts simply 1.6% Actual GDP development in 2023 and 1.7% in 2024.

Regardless of a difficult quarter for macro-economic development (U.S. GDP was up simply 1.1%), 1Q-2023 U.S. RevPAR rose 17% on a year-over-year foundation, pushed by a ten% improve in ADR and a 6% improve in occupancy. Moreover, 1Q-2023 RevPAR was 13% above 2019 ranges, pushed by ADR that was 17% above 2019 ranges.

Whatever the RevPAR power skilled within the first quarter, development in lodging fundamentals will noticeably gradual in 2Q-2023, pushed by a confluence of the next components:

- The erosion of sentimental year-over-year Omicronvariant-related comparisons.

- Tougher year-over-year leisure comparisons.

- Declining enterprise funding spending in 1Q2023, which is prone to influence the tempo of company journey restoration.

- Sluggish financial development.

Transferring ahead, {industry} development will must be fueled by the company and group segments. Whereas declining financial exercise has not had a significant influence on the lodging restoration to this point, because the cycle shifts from restoration into growth, financial exercise will turn into a main driver of efficiency. With the outlook for financial growth remaining muted, it’s our view that development in fundamentals will considerably gradual via the rest of 2023 and into 2024 and 2025.

There are a number of silver linings to our outlook for the U.S. lodging {industry}. Whereas the company restoration might be considerably depending on the return to the workplace, we count on workplace utilization to steadily enhance via 2023. As company demand remains to be effectively beneath pre-pandemic ranges, gentle financial development is unlikely to translate right into a pullback in company transient demand. Moderately, it’ll merely gradual the tempo of restoration, which nonetheless factors to constructive development.

Moreover, group tendencies seem strong, serving to generate a base degree of demand that can additional assist pricing energy. Nationally, we estimate that the conference heart reserving tempo is up 17% on a year-over-year foundation in 2023. Nevertheless, a lot of that power was tied to 1Q2023 and as we glance additional out, the 2024 conference reserving tempo is down 11% year-over-year.

Our financial forecast from Moody’s Analytics incorporates the next key nationwide assumptions:

- The Fed will pause price will increase till cuts start in 2024.

- Congress and the Biden Administration will keep away from a debt-limit breach.

- Inflation will drop to underneath 3% by year-end2023.

- U.S. GDP will improve 1.6% in 2Q-2023 and improve 1.6% for the complete yr.

We count on RevPAR development to meaningfully gradual in 2Q2023, however modestly reaccelerate within the second half of the yr. Total, we count on U.S. RevPAR to be up 6.6% this yr, adopted by 3.9% in 2024. Ought to any of the above core macroeconomic assumptions meaningfully change, it may have a considerable influence on our U.S. lodging {industry} forecast.

Our detailed, clear course of has regularly led to probably the most correct forecasts for the U.S. {industry} and for the precise markets we comply with. Throughout my January 2023 ALIS presentation I forecasted 2023 U.S. RevPAR development of 6.8% (which stays near our present 6.6% RevPAR development forecast) roughly double the forecasts of my fellow panelists. Since then, the {industry}’s forecasts have continued to maneuver towards ours. Whereas there’s numerous 2023 left to play out and an amazing quantity of financial uncertainty, we stay assured in our course of that yielded, not solely probably the most correct forecasts in the course of the previous a number of years, however one which was very a lot out of consensus to start out this yr and now seems increasingly correct with every passing day.

We proceed to count on there to be U.S. lodging markets that materially outperform in addition to those who underperform nationwide averages. Because the lodging {industry} shifts into the following stage of the cycle, we usually consider leisure markets will start to chill, whereas inbound worldwide demand ought to drive stronger development to gateway markets , nevertheless, they can even take the longest to completely get well to pre-pandemic ranges.

We additionally count on lodge capitalization charges to stabilize, financing prices to average and transaction volumes to rebound. Nevertheless, transferring ahead, expense pressures will turn into a considerable consider figuring out markets which are winners and people which are losers. Wage development and margin pressures materially form our views on markets which are greatest and worst for funding at the moment.

We consider the most effective enterprise selections are based mostly on the most effective data obtainable on the time of creating that call. We take that method with our forecasts, utilizing the most effective obtainable data to supply the most probably final result. As such, we consider transparency surrounding forecasting is essential to the lodging {industry}.

LARC’s industry-leading market intelligence referred to all through this doc may help all {industry} individuals navigate the present surroundings and place themselves for fulfillment because the {industry} navigates these unsure instances. Please contact us on to be taught extra about our providers and merchandise or if there’s another method we might be able to higher serve you.

LARC’s Trade Outlook

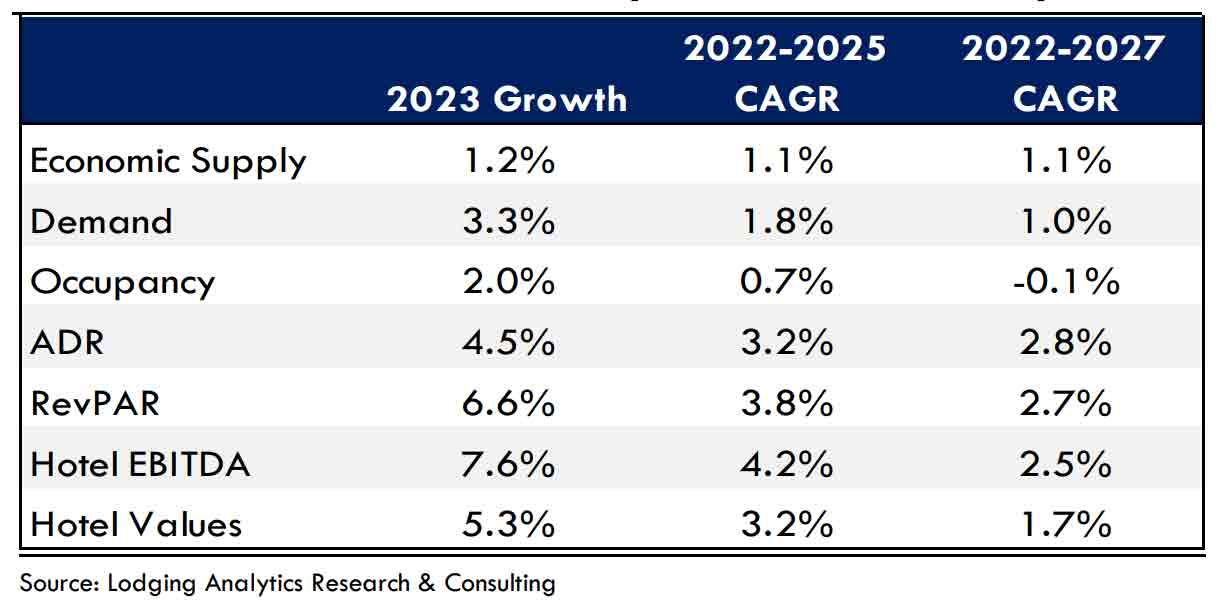

At the moment, Lodging Analytics Analysis & Consulting (LARC) expects U.S. RevPAR to extend by 6.6% to $99.45 in 2023, leading to an annual RevPAR that’s 15% above 2019 ranges. LARC anticipates ADR to rise by 4.5% this yr to $155.70, or 19% above 2019 ranges, whereas occupancy will improve 2.0% to 63.9%.

Regardless of difficult capital markets, LARC anticipates 2023 U.S. Lodge EBITDA to develop by 8% and Lodge Values to extend 5%. LARC believes 2022 Lodge Values had been merely 1% beneath 2019 ranges and that each Lodge Values and Lodge EBITDA will attain 2019 ranges in 2023. June 2023 U.S.

Lodge Trade Forecast Abstract

LARC’s U.S. RevPAR mannequin has an R-squared of 99.6% with a normal error of 4.7%, back-tested to 2000. LARC’s U.S. Cap Fee mannequin has an R-squared of 98.4% with a normal error of 26 bps, back-tested to 2005.

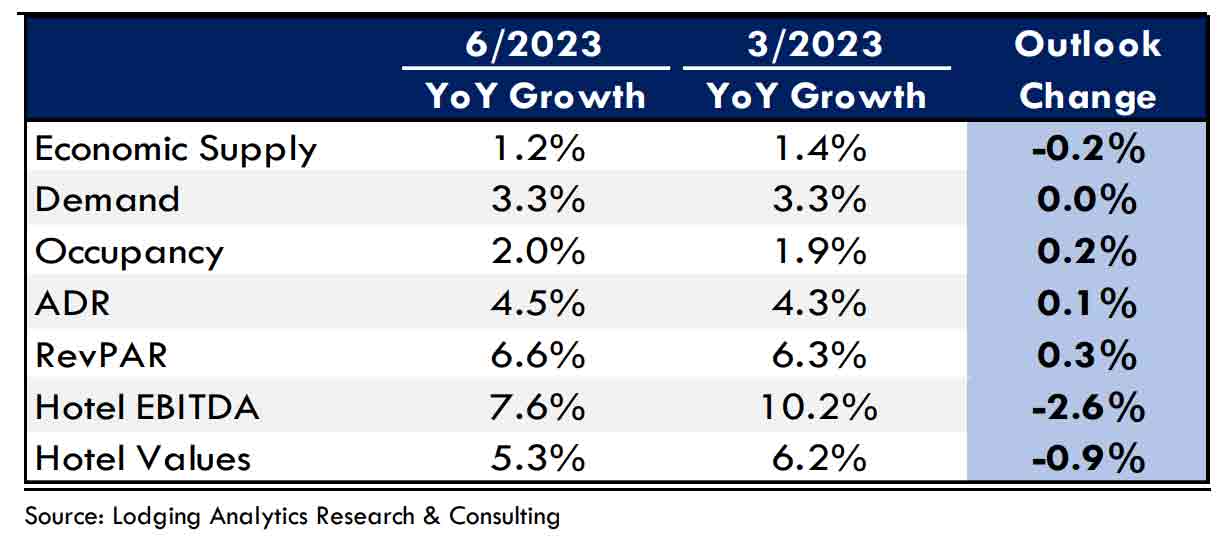

The next desk illustrates a abstract of LARC’s present U.S. Lodge Trade Outlook in distinction to final quarter’s outlook. In the end, our 2023 view for provide moderated barely, driving our occupancy outlook barely larger. Our outlook for ADR additionally elevated barely and mixed with our occupancy forecast enchancment, drives a modest 0.3% improve to our 2023 RevPAR outlook. Nevertheless, as our outlook for expense development elevated, Lodge EBITDA development slowed, driving Lodge Worth barely decrease.

2023 U.S. Lodge Trade Forecast: June 2023 Version vs. March 2023 Version

Market Outlooks

Under is an inventory of the most effective and worst performing markets based mostly on our forecasts. Just like LARC’s U.S. forecast, our market degree forecasts are constructed completely on multivariable regression fashions with excessive historic accuracy.

Extra element on our market outlooks will be present in LARC’s Market Intelligence Studies. Please contact us in case you are occupied with buying any of LARC’s choices.

2023 (relative to 2019)

Prime Markets for RevPAR Progress: Palm Seaside, Tampa, Phoenix, Puerto Rico and Cell

Backside Markets for RevPAR Progress: San Francisco, San Jose, Portland, Minneapolis and Columbus

2023 (year-over-year)

Prime Markets for RevPAR Progress: San Francisco, Washington, D.C., San Jose, Houston, and Honolulu

Backside Markets for RevPAR Progress: Miami, Omaha, Puerto Rico, Cell and New Orleans

2019 – 2027 Outlook

Prime Markets for RevPAR Progress: Palm Seaside, Cell, Puerto Rico, Las Vegas and Memphis

Backside Markets for RevPAR Progress: San Francisco, San Jose, Kansas Metropolis, Cincinnati and Louisville

Prime Markets for Worth Change: Puerto Rico, Tampa, Nashville, Las Vegas and Miami

Backside Markets for Worth Change: San Francisco, Portland, Boston, Chicago and St. Louis

Ryan Meliker

President

Lodging Analytics Analysis & Consulting, Inc